The establishment survey showed the economy added 379,000 jobs in February. In addition, the figures from December and January were revised up by 38,000. This brings the average job gain over the last three months to 79,700. Employment in the survey stands at 9,475,000 below its year-ago level.

The household survey showed the unemployment edging down to 6.2 percent, while the employment-to-population ratio (EPOP) also ticked up 0.1 percentage point to 57.6 percent. That is down 3.5 percentage points from its year-ago level.

Small Businesses and Older Workers Hit Hardest

Small businesses continue to be hard hit in the recession. The number of incorporated self-employed is down by 797,000 over the last year, or 12.3 percent. There is relatively little change in the number of unincorporated self-employed, but these businesses tend to be smaller and are often part-time, like selling items on the web.

By age group, workers over age 55 and workers between the ages of 20 and 24 have been hit hardest. Employment for workers over age 55 fell by 6.5 percent over the last year. The drop for the 20–24 group was even larger at 7.4 percent, but this is a much smaller group of workers. Workers between the ages of 35–44 have fared best, with a drop in employment of 3.7 percent.

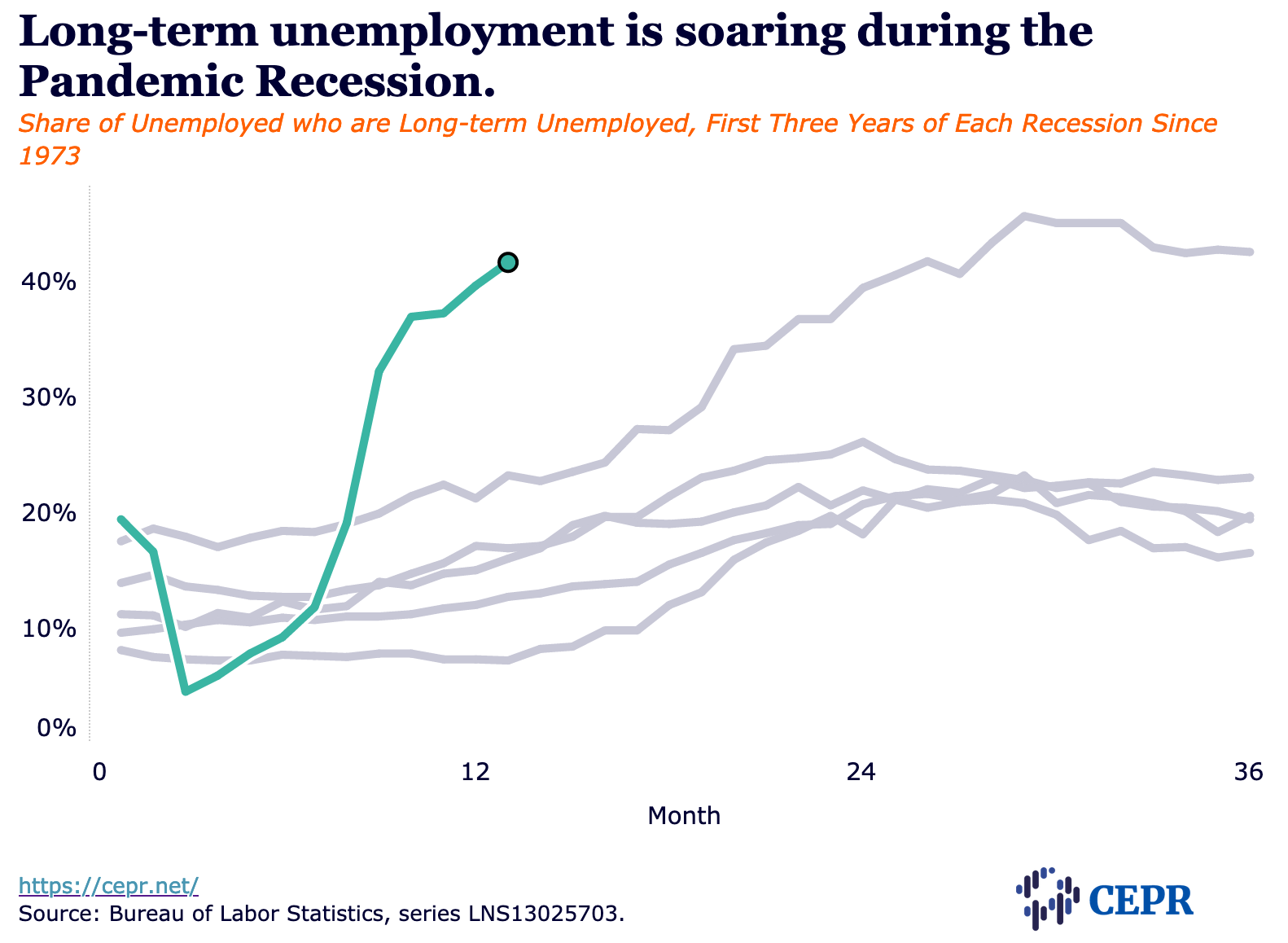

Share of Long-Term Unemployed Continues to Rise

The share of long-term unemployed rose by 2.0 percentage points to 41.5 percent. This is far higher than in prior recessions, where the share tended to peak not much over 20 percent, except the Great Recession, with a peak near 45 percent. This indicates that unemployment is highly concentrated among people who lost their jobs near the start of the recession, rather than workers going through relatively short spells of unemployment.

The share of the unemployed who are short-term layoffs fell sharply to 22.3 percent. The share, due to voluntary quits, rose 0.6 percentage points to 7.0 percent. This is still an extraordinarily low level. If we exclude the lows hit in the Great Recession, it would be necessary to go back to July of 1983, when the share hit 6.9 percent, to find a lower level.

Asian American Unemployment Rate Falls to 5.1 Percent

Unemployment rate for Asian Americans fell 1.5 percentage points to 5.1 percent. The unemployment rate for Asian Americans is typically slightly lower than for whites, but in the pandemic recession it has often been higher. The February drop again puts it slightly lower than the 5.6 percent unemployment rate for whites.

Another notable change was a 1.0 percentage point rise in the unemployment rate for workers with less than a high school degree to 10.1 percent. This is the highest since September, although the series is highly erratic, so this could be reversed.

Restaurants and Hotels Lead Employment Gains

Restaurants added 285,900 jobs in February, with hotels adding another 35,700. This obviously reflects gains in controlling the pandemic, but the two sectors together are still down 2,677,000 from a year ago. The temp sector was another big job gainer, adding 52,700. The sector has added 371,400 jobs since September, an average of 74,300 a month.

Retail added 41,100 jobs, putting it 362,600 below its year-ago level. Manufacturing added 21,000 jobs in February, but it is still 561,000 jobs below its year-ago level. Construction lost 61,000 jobs, but this was almost certainly due to the bad weather that hit during the reference period. State and local governments laid off another 83,000 workers in February, putting employment in the sector down 1,391,000 since pandemic started.

Wage Growth Looks Strong

The annual rate of wage growth, comparing the last three months (December, January, and February) with the prior three months (September, October, November), was 5.7 percent. This is somewhat above the 5.3 percent year-over-year growth, but that figure is skewed by the loss of many low-paid jobs.

Hours Fall in February

The length of the average workweek fell by 0.3 hours in February. This is almost certainly due to the weather. However, the drop in hours put the index of aggregate hours 0.4 percent lower in February than in November. This is noteworthy because output was almost certainly considerably higher in February than in November, implying large gains in productivity.

Productivity data are notoriously erratic, but we did have 2.4 percent growth over the four quarters of 2020, after a rise of 1.9 percent in 2019. Productivity growth had averaged just 0.9 percent from 2009 to 2018. If higher rates of productivity growth can be sustained, it should alleviate concerns about inflation.

Generally Solid Jobs Story in February

The data in this report are better than was generally expected, given the continued high levels of unemployment insurance claims. However, the economy still has very far to go before it can be considered anything close to normal.